We are all told to work hard in high school, make good grades, get involved in extracurricular activities – all that, so we can get accepted into the college of our dreams. Unfortunately what holds many families back from fulfilling their child’s dream, or individuals paying on their own, is affording that long-anticipated higher education. The problem is that many people aren’t aware of the many education opportunities available abroad as well as solutions for dealing with loans post-graduation.

College tuition has seen an astonishing 296% increase since the year of 1995, and 757% since 1980. (Debt.org) George Mason University’s tuition surpasses the average tuition cost in the US, according to TopUniversities. The average in-state cost of attendance (living expenses are factored in) for a public 4-year university is $20,090 (Bridgestock); out-of-state, naturally towering over in-state, is $35,370. GMU’s tuition for in-state students is approximately $26,912, and for out-of-state the cost is around $48,194. On February 15th, GMU held a Tuition Tell All event that was hosted by the Mason Student Government and featured J.J. Davis, Senior Vice President for Administration and Finance, and Rose Pascarell, Vice President of University Life. The talk shed a lot of light onto what the tuition goes to and why is it rapidly increasing. As explained by Davis, the institution is receiving less funding from the government and is essentially being asked to act as a private university. With constrained resources and poor economy, J.J. Davis, referring to the students, said “and you’re feeling the burden.”

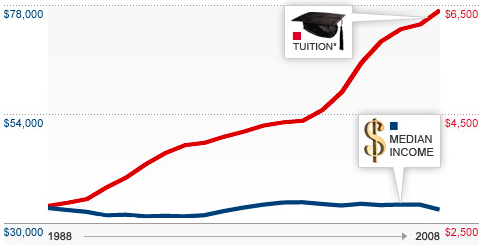

As the cost of college tuition is rising, the wages that pay for them are not. Wages over the same time period discussed above (1995-2015) have actually declined, once adjusted for inflation. For perspective, if pay rates had increased at the same rate that tuition has, the average American would now earn $77,000 a year in 2008, according to CNN Money. In reality, the average American earns closer to $33,000, or $400 less than 20 years earlier when accounting for inflation. While U.S. productivity increased by 80 percent between 1979 and 2009, the hourly wage of the median worker went up by 10.1 percent. The country’s high unemployment rate, currently at 9.1 percent, has only intensified that downward pressure on wages.

Rising Tuition Rate of Colleges and Stagnant U.S. Median Income

With tuition figures steadily increasing, college debt levels are astronomical. It is 2017 and US students are drowning in student loans now more than ever. As of April 2017, the total US student loan debt is $1.4 trillion, spread out among about 44 million borrowers. This is the second highest level of consumer debt behind only mortgages. (Consumer Financial Protection Bureau) This number is accrued by $3,000 every second. The average class of 2016 graduate is burdened by $37,172 in student loan debt, up six percent from the year before. (Student Loan Hero) One in four student loan borrowers are either in delinquency or default according the Consumer Financial Protection Bureau.

Data collected by CollegeFactual states that 43% of all undergraduate students (including freshman) at GMU take out federal student loans to help cover their college education, averaging $7,300 per year. (CollegeFactual) This is merely the average – some students will borrow much more than this. It has been shown that incoming students are offered more financial aid by Universities while returning students receive less as they are expected to take out more loans to continue their college education.

College students with loans dream of the day they will be debt free. Luckily, there are four primary programs to get federal student loan forgiveness that will cancel or reduce the amount of money a student owes.

First there is Public Service Loan Forgiveness. (McGurran) Your remaining federal student loan balance will be forgiven if you are employed full-time by a nonprofit or the government for at least 10 years and have made all the required 120 payments. You are not required to work at the same public service job for 10 consecutive years, contingent that all your jobs are in the public service sector then you will be qualified. The only loans that are eligible for this type of forgiveness are federal direct loans. Currently, there is no limit on the amount forgiven under Public Service Loan Forgiveness. In other words, the full amount of your federal student loans is eligible for forgiveness. (McGurran) The application for this student loan forgiveness program will be available in October 2017.

The second program is called Teacher Loan Forgiveness. Teachers play an indispensable role is our society. But it’s no secret that teachers are underpaid, which can affect how teachers pay back their student loans. Teachers who work full time for five consecutive years can have up to $17,500 in direct or Stafford loans forgiven. However, not all teachers are eligible: only teachers at low-income schools can be considered for this program. The Teacher Cancellation Low Income online directory provides a list of schools and educational service agencies with eligibility. Teachers that are considered ‘highly qualified’ and teach math, science, or work in special education are eligible for up to $17,500 in student loan forgiveness. ‘Highly qualified’ means obtaining state certification and holding a license in the state you teach in. You are eligible to apply for this loan forgiveness program only after your five consecutive years of teaching.

Then there is Perkins loan cancellation. If you have a Federal Perkins Loan and are interested in pursuing education, you are in luck. You can have up to 100% of your loans forgiven, in a short amount of time. Full-time teachers at low-income public or nonprofit elementary or secondary schools, or those that specialize in certain subjects, like math, science, and special education, are considered eligible. Teachers must work full-time for a full academic year to apply for this loan cancellation. Qualified teachers are eligible to have:

- 15 percent of their loans cancelled for the first and second years of service

- 20 percent of their loans cancelled for the third and fourth years of service

- 30 percent of their loans cancelled for the fifth year of service

Therefore, after five years of service, qualified teachers with Federal Perkins Loans can have 100 percent of the loans cancelled.

Finally, there is income-driven repayment. The federal government offers four main income-driven repayment plans, which requires the borrower to pay a percentage of their monthly income toward their loans. The four plans are: Income-Based Repayment, Income-Contingent Repayment, Pay As You Earn, Revised Pay As You Earn. Depending on the plan, after 20-25 years of making payments, all of these programs automatically forgive your remaining loan balance. What’s imperative to realize is that financial aid is completely dependent on the federal budget which fluctuates with the political climate and therefore, changes to the terms of forgiveness for these programs could happen at any time. Borrowers should stay organized and informed about their options.

While the US college student population is struggling with the costs of attending school at home, countries in Europe, like Germany for example, are offering “free” college education. Debt-free college in US has been discussed among several previous national democratic contenders. Hillary Clinton, as part of her 2016 presidential campaign, presented an optimistic education plan that would eliminate tuition costs at public universities for households earning up to $125,000. This proposition would reinstitute Ronald Reagan-era cuts on itemized tax deductions for high-income families. (Douglas-Gabrielle) The $450 billion education plan, dubbed the New College Impact, would have offered thousands of families across the country the opportunity for their child to receive a higher education. Another political figure that was a proponent of tuition and debt free college was Bernie Sanders. Sanders introduced his College For All Act which mirrored Clinton’s New College Impact education plan. It too aimed to eliminate tuition and fees at public four-year universities for students from families that make up to $125,000 per year (Zornick). The act would require the government to pay 67% of tuition fees while the remaining third would be covered by state and tribal governments. Both of the education plans introduced by Clinton and Sanders received many sponsors and was the driving force of their respective 2016 presidential campaigns.

Germany is a notorious leader in debt-free college education – open to both German and international students alike – and many U.S. students are taking advantage of this incredible opportunity. There are currently more than 9,000 enrolled American students in German institutions, a 20% increase over the last three years. At the Technical University of Munich (TUM), one of the most highly regarded universities in all of Europe, students pay a semester fee of €111 ($120). (Strasser) Included in that fee is public transportation which enable students to travel freely around Munich. Health insurance for students in Germany is €80 ($87) a month, much less than what parents would have had to pay in the US to add their child to their plan. An American student, Hunter Bliss, is studying physics at TUM and his parents are paying the aforementioned fees. His parents send him between $6,000-7,000 per year to cover rent, health insurance, and other expenses. If Hunter were to go to the nearest university back home, the University of South Carolina, his parents would easily have to spend three times that per year. (Jackson) Housing, books, and other expenses would make that number go even higher.

College degrees have never been more necessary to compete in today’s job market. The irony is that while tuition is notably increasing, American wages have remained stagnant. Students are going to school with less money and end up drowning in student debt by the end of their undergraduate years. It is essential that college students today are aware of all the options they have to receive a higher education and remain well-informed of ways to prevent the burden of student debt.

Leave a comment